Big Bull and Big Bear This blog is for people trying to find their way to financial freedom. The methods that I have are mostly for working people. I post my trades and thoughts on markets and have friends and family learn from these simple methods.

Sunday, March 27, 2011

How to add a Script to Thinkorswim Platform

Labels:

Accumulation,

Amazon,

Distribuiton,

Game Changer,

Script,

Stocks,

Thinkorswim,

Thrust

Saturday, March 26, 2011

Finally seeing the lights after almost one month

As you can see from the chart below, we have slowly crawled out the dark regions. Markets for the past week has been slowly creeping up.

via StockCharts.com

"

On late Friday, I initiated two positions in my ETF account, EWD and THD with stops at 13.25 and 63.36 respectively. These are starter positions as I expect a bit of volatility as markets has not cleanly broken out.

The chart that I use to see whether we have a clean breakout is the accumulation and distribution chart.

If you need the ThinkorSwim code for this please e-mail me on marketing1977@gmail.com, I will be glad to provide it.

The other ETF that I am interested in are CZM, TQQQ, ERX and EDC. As usual, we will allow market to tip its hand first and then we make the move.

I am reading this book this week to understand the dark side of derivative business.

Saturday, March 19, 2011

Still No sighting of light at the end of the dark tunnel - HAPPY HOLI

As you can see from the charts below, we are still in correction mode. I will not go into the market this this chart tells me. For it to tell me that waters are clear. I would like this chart to cross above its 10 day MA which is right now sitting at 71.71. (a nice number).

$BPNYA - Daily Candlesticks: "

via StockCharts.com

"

While all of us are going through sorting out the priorities, I keep on reminding myself this simple message. Enjoy your life to the fullest and wish you all HAPPY HOLI

Books to read:

Thursday, March 17, 2011

Markets still in correction

Markets still in correction. Not buying anything

Publish Post

Currently Reading books:

More Money Than God: Hedge Funds and the Making of a New Elite

Some good books to review:

Damodaran on Valuation: Security Analysis for Investment and Corporate Finance

How to Trade In Stocks

Publish Post

Currently Reading books:

More Money Than God: Hedge Funds and the Making of a New Elite

Some good books to review:

Damodaran on Valuation: Security Analysis for Investment and Corporate Finance

How to Trade In Stocks

Monday, March 14, 2011

They also serve who Stand and Wait

Last week's post on Capital Preservation is still in place. I am still not ready to get back in the water.

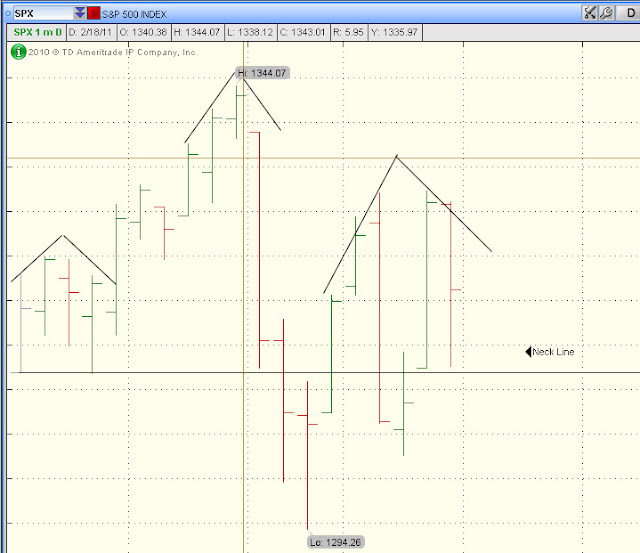

As posted last week, I will only get in after I see an end to that nasty Head and Shoulders pattern. Looks to me this pattern is working for bears. But we remain patient and then try to get in.

The first neck line is now broken as you can see from the above chart.

As posted last week, I will only get in after I see an end to that nasty Head and Shoulders pattern. Looks to me this pattern is working for bears. But we remain patient and then try to get in.

The first neck line is now broken as you can see from the above chart.

Saturday, March 12, 2011

Broker Review

Some of you have mentioned that brokerage is too expensive or your brokers don't provide enough service.

Here is the overall broker comparison from Barrons. I had picked up Thinkorswim in 2002 from a similar Barron's article back then.

http://tinyurl.com/bigbullandbigbear

http://online.barrons.com/article/SB50001424052970204309104576172474236806378.html

Courtsey: Barron's

Here is the overall broker comparison from Barrons. I had picked up Thinkorswim in 2002 from a similar Barron's article back then.

http://tinyurl.com/bigbullandbigbear

http://online.barrons.com/article/SB50001424052970204309104576172474236806378.html

Courtsey: Barron's

Saturday, March 5, 2011

Capital Preservation Mode, Death by Thousand Cuts Markets

Some time I go I had posted some of the charts I like to monitor for Bear prowls and how to protect ourselves from the distress it causes to our hearts and our portfolios. I am currently sitting on cash with some small positions in stocks.

We review those same things again

These are some of the charts that I like to use to time the market along with some other indicators

Another pattern that is developing is the nasty Head and shoulders pattern in SPX chart.

If this pattern does not really come into play then we are looking at an explosive move up. But till we Mr. Markets shows us his hand, we sit on hands and be in the Capital Protection mode.

Labels:

BAL,

Commodites,

Dollar,

ETF,

Markets,

Middle East,

SGG,

SPX

Subscribe to:

Posts (Atom)