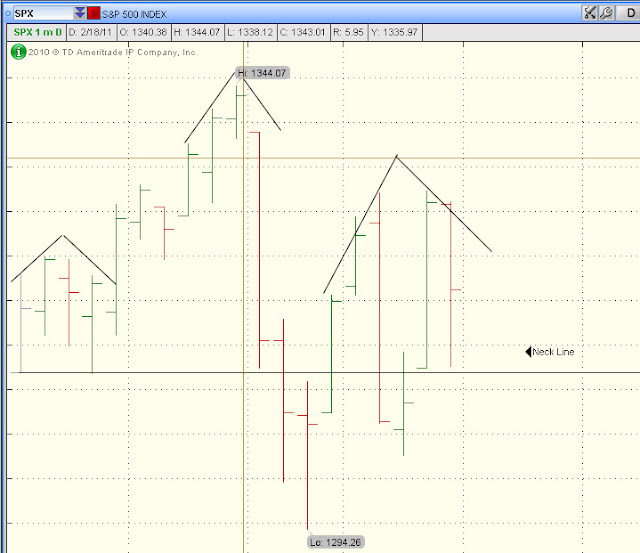

As you can see from the chart below, we have slowly crawled out the dark regions. Markets for the past week has been slowly creeping up.

via StockCharts.com

via StockCharts.com

"

On late Friday, I initiated two positions in my ETF account, EWD and THD with stops at 13.25 and 63.36 respectively. These are starter positions as I expect a bit of volatility as markets has not cleanly broken out.

The chart that I use to see whether we have a clean breakout is the accumulation and distribution chart.

If you need the ThinkorSwim code for this please e-mail me on marketing1977@gmail.com, I will be glad to provide it.

The other ETF that I am interested in are CZM, TQQQ, ERX and EDC. As usual, we will allow market to tip its hand first and then we make the move.

I am reading this book this week to understand the dark side of derivative business.